How Many Miles To Valdosta Georgia

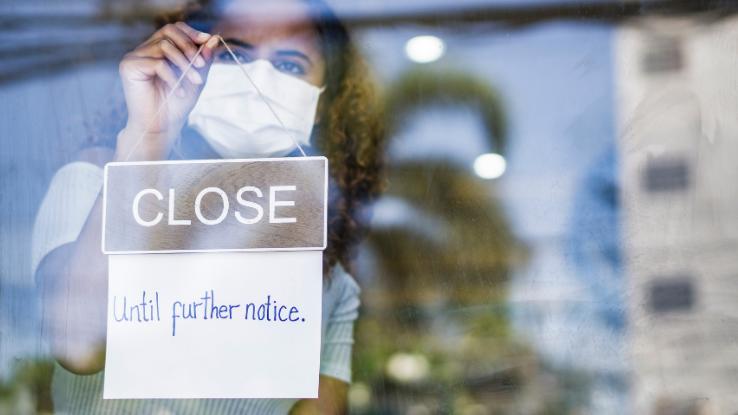

The COVID-19 pandemic has led to a loftier unemployment rate in Georgia, leaving effectually 273,000 Georgians without jobs. In the 2d week of September, 42,000 Georgians filed for unemployment benefits. While many people are still filing for unemployment, the Georgia Section of Labor (GDOL) has as well implemented some benefit changes.

As well regular unemployment insurance, there are a few new programs to help people who are out of work in the meantime. Yet, each program has differing payment plans and requirements for eligibility. If you're wondering whether you might qualify, nosotros can assistance you figure out the terms you'll want to know and the ways to cheque your unemployment application and condition.

Due to COVID-19, some Georgians are eligible to receive an boosted unemployment do good worth $300 weekly upwardly to a total of $1,800. The extra payment is part of the Lost Wages Assistance (LWA) program, a new project supported by the FEMA Disaster Relief fund.

There'south a full of two supplemental payments, each roofing three weeks' worth of $300 checks to total $900 apiece. According to the Department of Labor, the program's first circular of checks was issued on September xiv, 2020. The rest were sent past the end of the week. Notwithstanding, just qualified Georgians are receiving these bonuses.

Who is eligible? Any Georgian who's receiving $100 or more in benefits and is unemployed due to the COVID-19 pandemic can look to meet the actress payment. But information technology's all-time to check your actual eligibility and payment condition past logging into the My U.I. portal.

Will more than LWA benefits exist provided? There'south no official word on extra LWA benefits for the rest of the year. Additional benefits depend on the residuum of the FEMA Disaster Relief fund.

Pandemic Unemployment Assist for Specific Workers

People who are cocky-employed, gig workers, 1099 independent contractors, church building employees, non-profit employees or anyone with little work history tin receive Pandemic Unemployment Assistance (PUA) unemployment benefits. Nonetheless, those who are eligible for state benefits won't qualify for federal PUA.

If you filed a state unemployment merits and were denied land benefits, you should receive an email with instructions to apply for PUA. In some cases, the link to the PUA application appears in the My U.I. portal. The GDOL has also added new questions to aid people better determine their eligibility for PUA.

After applying, you will receive another electronic mail asking you to send piece of work and wage data. The e-mail also has a link for you to certify (request payment) for all the weeks your business concern has been closed due to COVID-19. Side by side, a letter that comes in the mail will state if yous were approved or denied. Those who are canonical will learn the corporeality of their PUA weekly benefits. According to the GDOL, "If a claimant receives at least one dollar in federal PUA benefits, they will be eligible for the weekly $600 supplement that will be back paid from the implemented date of 4/4/2020."

The Pandemic Emergency Unemployment Compensation Program Supplements Unemployment Benefits

The Pandemic Emergency Unemployment Compensation (PEUC) programme is an extension of a regular unemployment insurance (U.I.) claim that adds 13 weeks of benefit payments on tiptop of the regular U.I. benefits. To qualify for this U.I. benefit, the claimant must have been unemployed between March 29 and December 26, 2020, and exist able to piece of work. However, the applicant won't be eligible for PEUC if they qualify for land or federal benefits.

If you run across the program's requirements, the GDOL will send an email or letter with further instructions for claiming PEUC. Sometimes, information for this plan is updated in the My U.I. Portal.

When and How to Contact the GDOL

If you haven't received any updates on your application or benefits, you should call and email the GDOL. It's currently experiencing delays in processing applications and sending payments only is continuing to work through the backlog.

Important Telephone Numbers:

Unemployment Insurance (U.I.): 404-232-3001

Appeals to the Board of Review: 404-232-3325

Appeals to Hearing Officers: 404-232-3900

Electronic Wage Reporting: 404-232-3265

Employer Claim Charges: 404-232-3030

Employer Tax Liability: 404-232-3301

Employer Tax Rates: 404-232-3300

Employer Tax Reports/Filing: 404-232-3220

General Tax Information: 404-232-3320

Interstate Claims: 404-232-3090

New Employer Accounts: 404-232-3301

Partial Claims Filing for Employers: 404-232-3050

U.I. Client Service: 404-232-3001, 877-709-8185

U.I. Policies and Procedures: 404-232-3180

Tax Administration: 404-232-3320

When yous email your questions and concerns to the GDOL, make certain you don't include confidential information, such equally your Social Security number or personal identification number (PIN).

Wondering how to file for unemployment online for the first time? Take a look at our guide to help yous through the process.

Source: https://www.askmoney.com/taxes/georgia-department-of-labor-unemployment-benefits?utm_content=params%3Ao%3D1465803%26ad%3DdirN%26qo%3DserpIndex&ueid=4cdb4c6c-91e4-4aae-893c-d420817e3e60

0 Response to "How Many Miles To Valdosta Georgia"

Post a Comment